Requiem for Silicon Valley Bank

The Crash

In 2023, venture capitalists blew up Silicon Valley Bank by ordering a bank run.

Marching orders came from the top of Founders Fund (Peter Thiel’s VC firm), Andreessen Horowitz, and YCombinator. Our worst enemies. The folks now executing an active coup of America.

As events unfolded, Bloomberg reported that “Founders Fund, the venture capital fund co-founded by Peter Thiel, has advised companies to pull money from Silicon Valley Bank amid concerns about its financial stability, according to people familiar with the situation.”

Axios reported: “By Thursday morning, Founders Fund's top operations executives were on the phone, quickly deciding to move firm capital to a number of bigger banks.”

The gang was all there; in Fortune:

“On a forum for Y Combinator startups, the accelerator’s president Garry Tan wrote, ‘Anytime you hear problems of solvency in any bank, and it can be deemed credible, you should take it seriously.’ In an email thread of more than 1,000 founders backed by Andreessen Horowitz, many entrepreneurs were encouraging each other to pull cash from the bank. David George, a general partner at the firm, weighed in somewhat cryptically: ‘Hi all, We know you have questions about how to handle the SVB situation,’ he wrote. ‘We encourage you to pick up the phone and call your GP.’"

The problem with Garry Tan stating there was a solvency problem, is that there was not a solvency problem.

In the immediate aftermath of the collapse, the NY Times reported “The failure of Silicon Valley Bank was caused by a run on the bank. The company was not, at least until clients started rushing for the exits, insolvent or even close to insolvent.”

The idea it was insolvent or close to insolvent — as forwarded by venture capitalists — was an open lie. And they knew it. Because they were privy to the bank’s interiors and always were. As JP Morgan would note in its annual report: “Interest rate exposure, the fair value of held-to-maturity (HTM) portfolios and the amount of SVB’s uninsured deposits were always known — both to regulators and the marketplace.”

So. The pretense for causing the bank run? Flimsy.

Yes, Silicon Valley Bank was rebalancing for weaknesses in its portfolio. From Bloomberg:

“SVB said it had sold about $21 billion of securities from its portfolio with a plan to reinvest the proceeds, which will result in an after-tax loss of $1.8 billion for the first quarter. SVB also announced offerings for $1.25 billion of its common stock and $500 million of securities that represent convertible preferred shares. Additionally, General Atlantic committed to purchase $500 million of common stock, taking the total amount being raised to about $2.25 billion.”

Put this in context: $1.8 billion in losses sounds like a lot… but at the time of the bank run, Silicon Valley Bank had about $200 billion in assets. This is not an amount of money that should kill-shot the bank — this is big boy land. SVB was actively making progress to recover that $1.8 billion loss. Following the sale — the responsible thing to do, and a move towards fortifying the bank: “Moody’s downgraded the bank, but only by a notch because of SVB’s bond portfolio sale and plan to raise capital.”

Nothing in the world can convince me that venture capitalists — who regularly cause booms and busts and thrive in a world of risky and bursty financial projects — lost their shit over a “notch” sized downgrade by *checks notes* Moody’s over a rebalancing of the portfolio. LMFAO.

One reason for the jitter is that SVB had been going through a huge growth period, which then stalled during the “crypto winter”:

“Following the pandemic, SVB saw an explosion in deposit growth, as low rates led venture-backed companies to raise large sums of money. From Q1 2020 to Q1 2022, SVB’s deposits grew 220%, compared to 26% deposit growth at all FDIC-insured institutions during that time frame…

The venture-backed boom began to shift in 2022 as rising interest rates and tightening financial conditions shut down funding markets for venture-backed companies. U.S. Venture-backed funding activity peaked in Q4 2021 with $94 billion of investment activity, and subsequently declined 62% to just $36 billion dollars of activity in Q4 2022. SVB estimated investment activity was on track to decline a further 15%-20% sequentially during Q1 2023.”

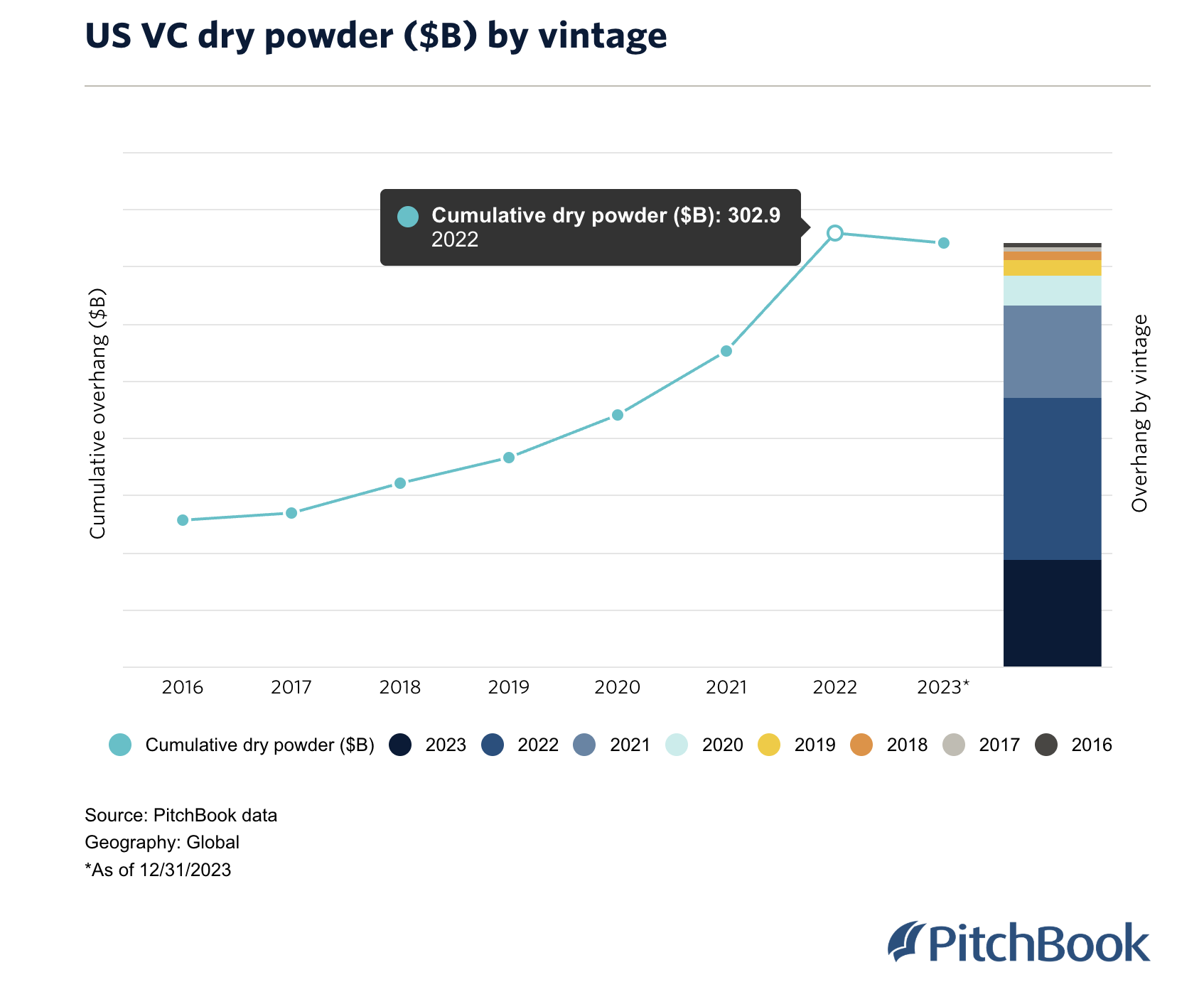

And none of this could have taken venture capitalists by surprise.. because it was their lack of spending causing the decrease… even though they had plenty of cash on hand. In fact… $300 BILLION OF IT.

Per the always diligent folks at PitchBook: “For venture capital (VC) and private equity (PE) firms, dry powder refers to the amount of committed, but unallocated capital a firm has on hand. In other words, it’s an unspent cash reserve that’s waiting to be invested.”

The Fed investigation of the bank collapse after, suggested that a bit more capital and liquidity would have soothed the matter over. Something the bank was in the process of achieving. But they never had the chance. And btw: if only venture capitalists were sitting on over $300 billion in cash to lend a hand to their favorite bank during a slow down in funding they themselves were causing!!

In the end, across the board is the conclusion that the bank did not collapse on its ownsome or out of need.

Indeed, this was the conclusion of JP Morgan Chase, in its Annual Report:

“Interest rate exposure, the fair value of held-to-maturity (HTM) portfolios and the amount of SVB’s uninsured deposits were always known — both to regulators and the marketplace. The unknown risk was that SVB’s over 35,000 corporate clients — and activity within them — were controlled by a small number of venture capital companies that moved their deposits in lockstep.”

Silicon Valley Bank had operated since… 1983. Before I was born I might add. This bank was over 40 years old and had taken the Valley though multiple rounds of crisis including the dot com crash, 9/11, the bank crash of 2008, and COVID. It was a champ for our industry and they got taken to the glue factory over hay.

Venture capitalists not only did not have to run this bank, but they could have easily “saved” it from the “crisis”… and we’ll never know, but I would bet a whole lot of money that if the psycho reckless power-mad fucks who were about to coup the American government, hadn’t sicced their sycophantic Hacker News hoards on this, Silicon Valley Bank would have pulled through just fine.

But they didn’t want it to.

The Outflow

Now what happened after the bank run?

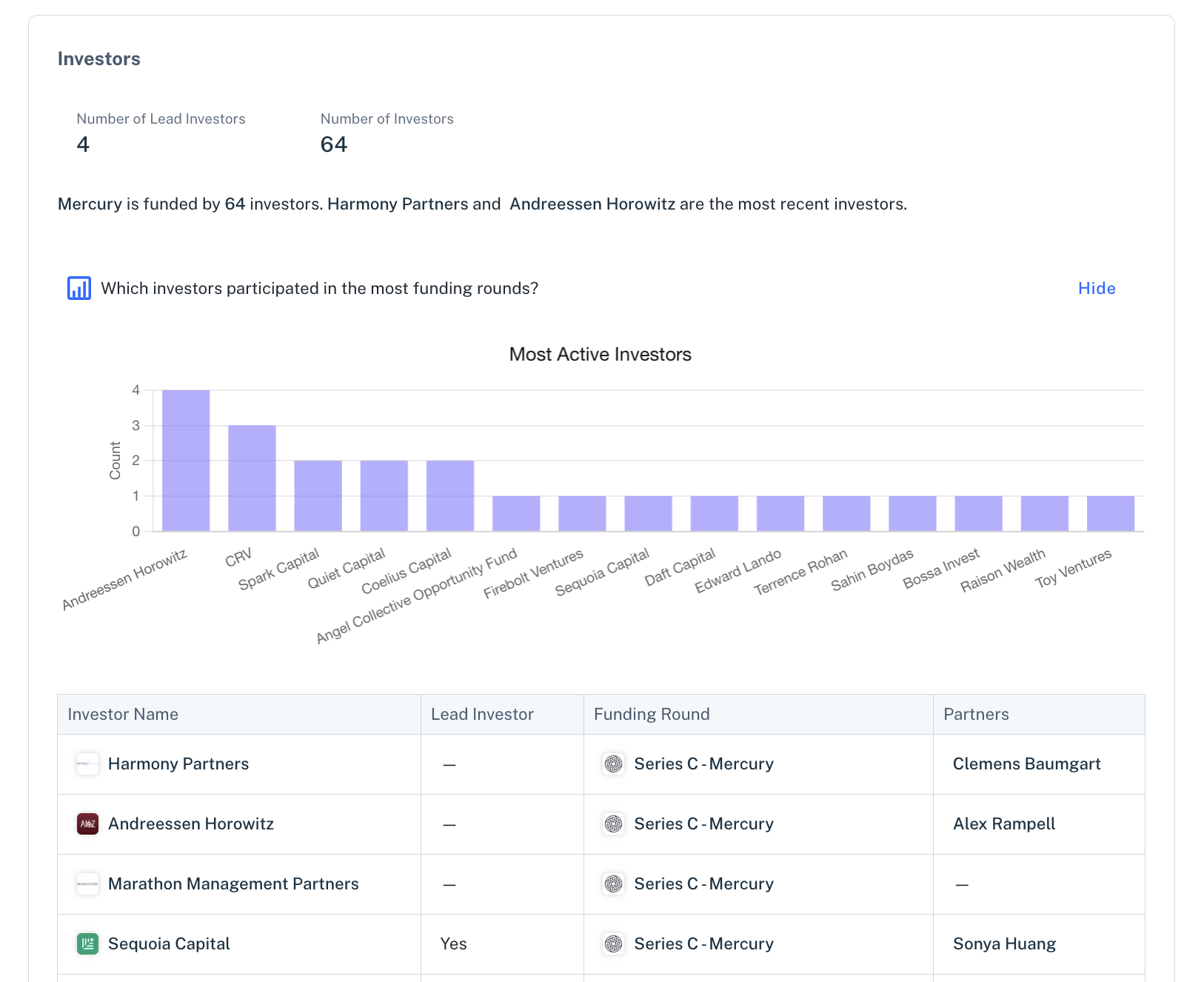

It will not surprise you that a ton of the money leaving Silicon Valley Bank in the bank run caused by Founders Fund, YCombinator and a16z… went directly into their own financial infrastructure.

Silicon Valley Bank was not their bank. They just banked there.

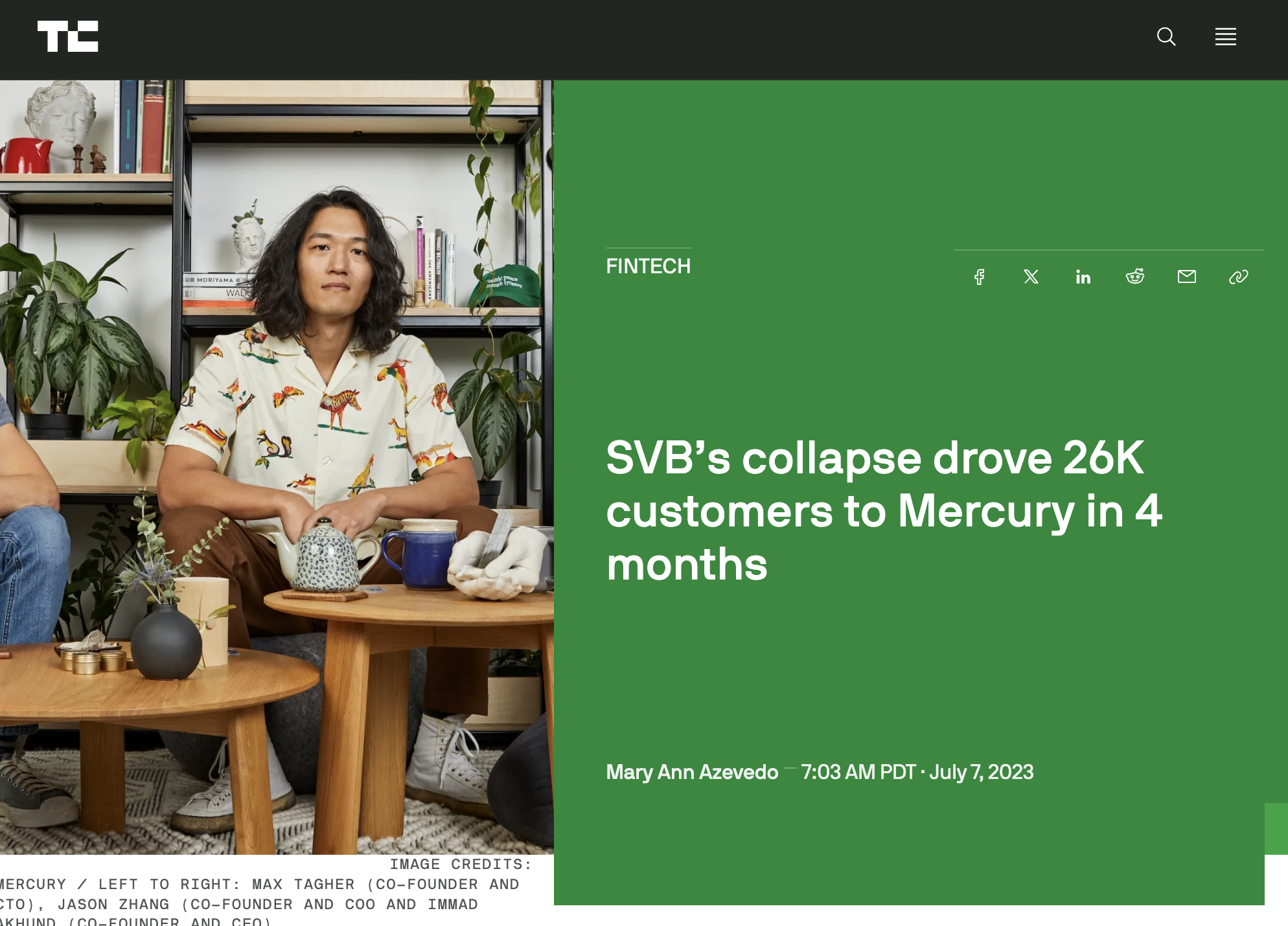

But by the time Silicon Valley Bank was hit by the smooth criminal syndicate of Founders Fund, Andreessen Horowitz and YCombinator… they had their own banks. Directly competing banks. Such as Mercury. Which explicitly advertised itself as a competitor to SVB even before it blew up. Founded 2017. Top investor: Andreessen Horowitz.

Deel, yet another piece of tech fascist financial infrastructure, brought in new customers as well:

Nor does the fun stop there. There were more IMMEDIATE GAINS to the venture capitalists in the IMMEDIATE WAKE of the “disaster”.

From the report by Coinbase on the collapse of Silicon Valley Bank: “Overall, we believe the medium to long-term outlook for cryptocurrencies has been reinforced to the upside. The technology behind open trustless blockchains and transparent smart contracts stands in stark contrast to the poor risk management practices that led to the turmoil witnessed in the US banking sector this week. That supports the fundamental arguments in favor of digital assets as an alternative and solution to the points of failure witnessed in the existing financial system.”

“The 40-year reign of Silicon Valley Bank as the preferred provider to tech startups ended this week with a suddenness and brutality that shocked even the most veteran observers of financial meltdowns.

This was the Covid moment for financial services. SVB’s rapid demise accelerated digital banking adoption by years, with billions of dollars of deposits funneled into digital banking competitors overnight.”

The contributor, a fintech CEO, his DIGITAL BANK, Arc Technologies, funded by NO LESS THAN YCombinator, stated further:

"I know this shift is underway because I'm seeing this play out in my company right now. In this column, I avoid writing about my fintech company, Arc, which is one of these ‘fintech software banks,’ yet I need to explain that in just the last week, our customer deposits grew more than they have in the last two years. And they’re on track to double again soon. Companies that had their cash with SVB and other traditional banks have turned to Arc and other fintech firms to manage their deposits because we programmatically diversify them amid a regulatory environment which still doesn't do enough to protect depositors.”

And those are just a few of many pieces of evidence that hitting the bank was immediately beneficial, and beneficial in the medium and long run, to the venture capitalists who did it.

To Recap:

Immediately after these VCs run the bank, a fuck ton of money goes into THEIR banks, a number of customers go into their other fintech companies, Bitcoin comes out smelling like a fuckin rose, and Coinbase — one of the biggest infrastructure plays in crypto, funded by Andreessen Horowitz, states that the bank collapse is… good for crypto.

And this was the sentiment across much of the crypto world.

Now who *was* the bank’s collapse bad for, if not the venture capitalists who called a run and then bitched and cried for a bail-out to cover their tracks while stuffing money into their crypto startups? Traditional finance, of course.

Take it away Jamie Dimon:

“These failures were not good for banks of any size. Any crisis that damages Americans’ trust in their banks damages all banks — a fact that was known even before this crisis.”

The traditional banking and finance system is the enemy of crypto, whose growth is reliant on being able to successfully cannibalize and onboard capital and assets from the existing financial system.

Which is exactly what happened with Silicon Valley Bank.

Collapsing SVB jeopardized the existing financial system, and could have caused a much wider financial crisis — just on VC-manufactured fear, uncertainty and dismay.

WEIRD !!!!!!

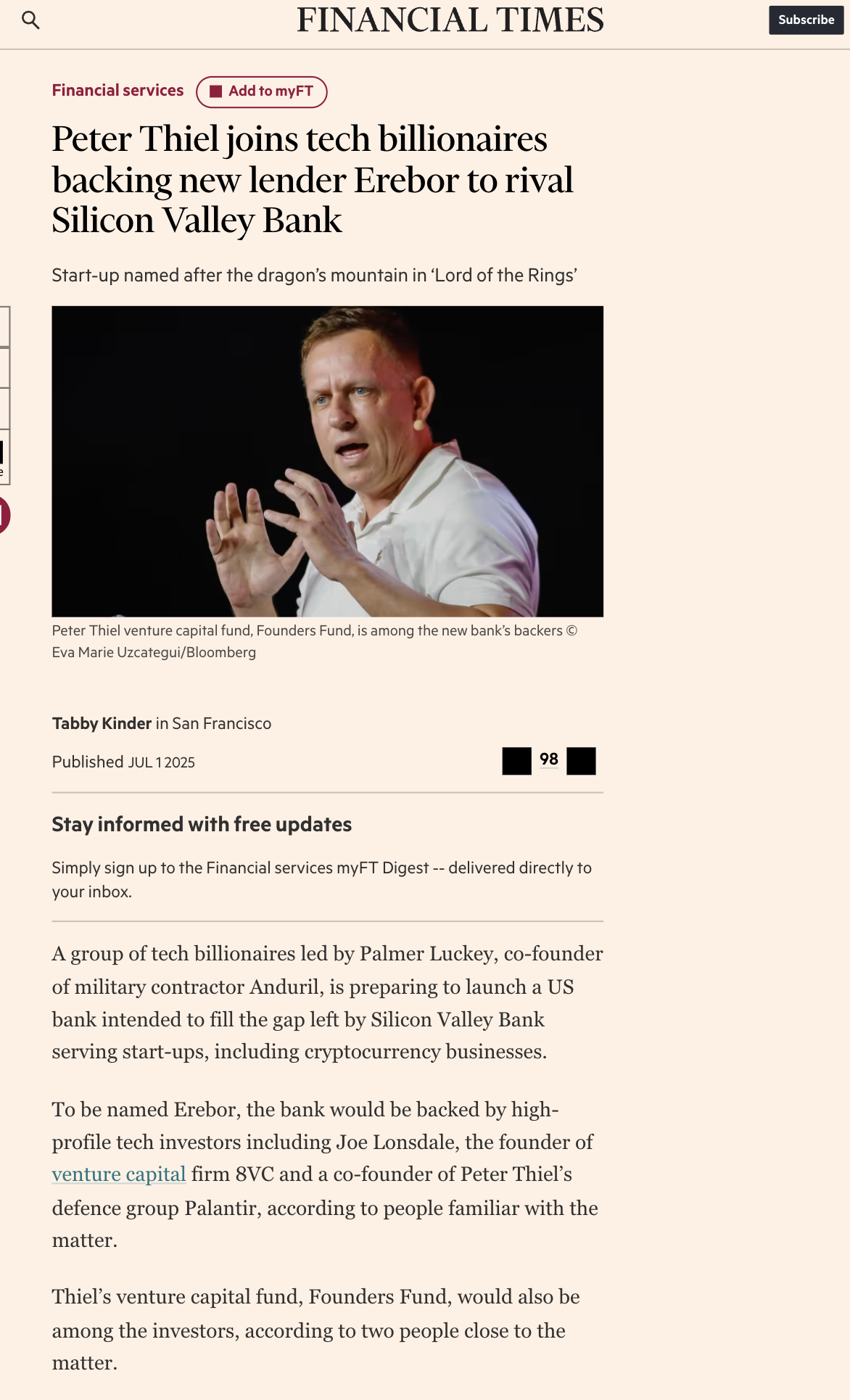

Most recently, news that the very same venture capitalists who ordered that bank run… are starting their own… Silicon Valley Bank.

But with a LOTR twist, for it will be called Erebor:

“Peter Thiel and other tech billionaires have reportedly spotted a major market opportunity in the void left by Silicon Valley Bank’s (SVB) 2023 collapse. They are now planning to launch a new financial institution — named after a Lord of the Rings reference — to serve crypto companies and startups that have struggled to secure financing since SVB’s downfall.

SVB’s dramatic collapse in 2023 triggered contagion across the US banking sector and led to tighter lending standards. While its assets were later acquired by First Citizens Bank, no institution has stepped in to fill SVB’s unique role — until now.

For context: Before its collapse, SVB banked nearly half of all venture-backed technology and life sciences companies in the United States.”

WEIRD !!!!!!

And Now We Arrive at Shanley Commentary, What We Are Here For

When the bank exploded, venture capitalists knew that they were headed into the start of the web 3.0 bubble. They were about to start throwing money around like Larry Ellison at watches, resorts and sailboats. They knew they were going to try to take over the government, they knew a new age of computing was about to come online in new datacenters, they knew that Saudi money would soon be coursing through their veins.

WHY WOULD THEY WANT ALL THAT MONEY GOING INTO SILICON VALLEY BANK WHEN IT COULD BE GOING INTO THEIR NEW BANKS AND CRYPTO FINANCIAL INFRASTRUCTURE?

So they made sure it didn’t.

Detonating Silicon Valley Bank from orbit was strategic. It benefitted them. It helped kick off the crypto bubble. And it fulfilled the promise of crypto’s incentive: to blow the economy the fuck up. The incentive was always there. And ultimately, whether or not you believe that venture capitalists cold-bloodly did this — which they absolutely did — the incentives made it inevitable. Venture capitalists are financial terrorists.

That incentive trajectory has only more explosions and demolitions to go. Venture capitalists are incentivized to blow up the financial system and scoop up all the cash and assets on the way out.

Silicon Valley Bank was a first run. The next one will be 100x - 1000x more before it is total. As the hostile crypto financial system, and its venture capital operators, grows more powerful, the stakes and the incentives grow. And things will be exploding all around us soon.

RIP SVB. With friends like these, you had no chance.