We Need to Talk about Base - Coinbase's superapp, the economic death star, blockchains as sovereign nations

Coinbase — the massive crypto play from Andreessen Horowitz — is out with its new super-app, Base.

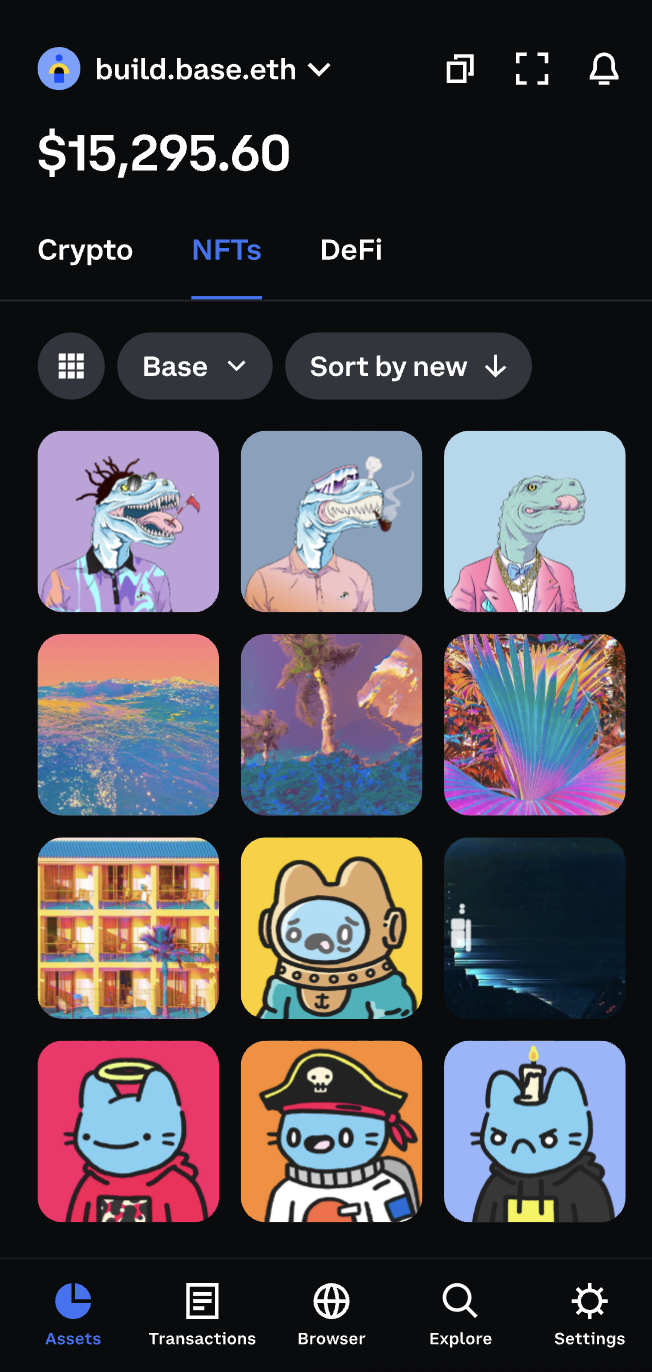

Base is the fullest expression yet of what “crypto” really is: a new financial system with a dizzying array of apps, coins, NFTs, social experiences, gaming and gamification, payments platforms, loans companies, memecoin casinos, loans, savings programs, art and music, stuff for creators, retail platforms for transactions. Coinbase’s Base app is the app store to new financial system, and it is quite a trip.

Here’s some of the stuff on the Base app. And btw, don’t let the words “blockchain” throw you off of any of this just because you don’t understand databases. These are just applications that use venture capital-owned infrastructure instead of the infrastructure of traditional finance.

Here’s a peek from Coinbase marketing, little rough around the edges but a new design is coming soon, and you’ll notice immediately is has social features built in.

Now you might think to yourself, NO ONE WOULD USE SOCIAL FEATURES ON COINBASE, but you are WRONG. Crypto has created a huge and vibrant community, where people talk about crypto all day everywhere in the world around the clock. Coinbase has 105 million users as of earlier this year. I’ve spent many years in and out of the crypto community, many of them are quite likable except for the Bitcoiners, and that shit is absolutely popping and probably one of the most dynamic internet communities in the world. Flowing capital from the VC subsidy tends to do that. Cash is explosive, fun, generative and energizing. The social nature of crypto fits very well in here.

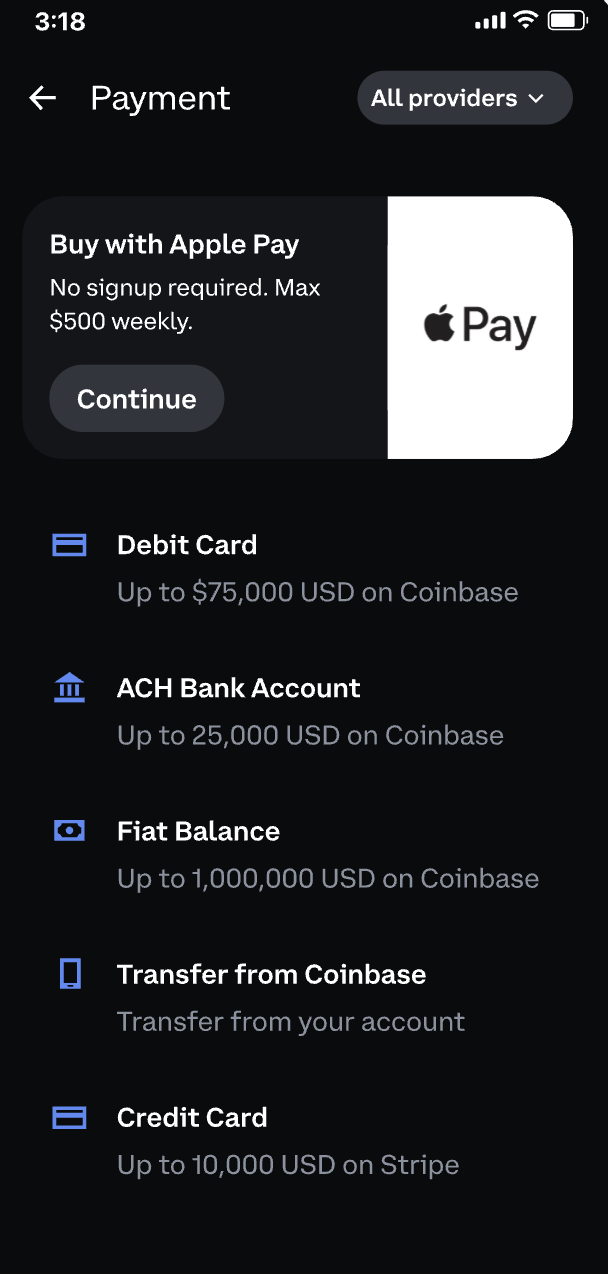

One of the features of Base is that it makes it really easy to get money into and out of it, check out those integrations with Apple Pay and Stripe credit card processing.

The appifi-cation of crypto is the most interesting thing here.

Here are some of the apps on the platform:

Financial products for lending, borrowing, and staking — which allows people to make money off their crypto and demonstrates that core financial products from traditional finance are being replicated here… and then some. There’s an app that lets merchants sign up to accept payments in USDC. Apps that let you launch your own memecoin with ease (what could go wrong?) Lots of shit for swapping.

Monetization platforms for AI art and movies, streaming and influencer shit. To me this highlights that creators are really being pushed into crypto and AI, because that is what the new platforms are for and what will make it possible to monetize. A lot of money can and is being spent to provide subsidies to these platforms that will allow users to make more money than the platform can provide out of its own profits. AI becomes the platform for creators and crypto its monetization and marketing engine.

And no, NFTs are not dead you silly hamsters.

Coinbase is marketing this as a new “everything app”, in their perpetual pursuit of China’s successful model: WeChat, which has 1.34 billion users.

Most importantly, Base will be one of the biggest applications for the CRYPTO STOCK MARKET. One of my main points over the years is that THERE WILL BE A CRYPTO STOCK MARKET where companies are IPOing on crypto, stocks are tokenized on crypto and running on VC shit, and over time, the financial infrastructure underlying the stock market and other huge parts of the economy, will live on venture capital financial infrastructure. And infrastructure = power, particularly financial infrastructure. (The same is true of stablecoins, btw — they move the dollar onto venture capital owned infrastructure, subordinating it, a direct assault on the sovereignty of this country.)

I think what Base does is bring to life a very clear idea of what is meant by “crypto”. Most people think that crypto is just a few coins. Little knowing that “crypto” is a dizzying array of products and services. The new Base app is above all AN APP STORE for a huge number of applications and features.

I will do a more in-depth piece on this later, but a recent report came out from Fidelity, a VERY VERY VERY interesting report, which advised the market about how to think about and quantify and reason about the various blockchains, entitled “Blockchains as emerging economies: A fundamentals-based framework to assess the economic activity of a blockchain may help asset allocators in their investment decision-making.”

“The investor community has struggled with how to frame cryptocurrencies and often relies on a centralized version of the internet (commonly referred to as web2). Blockchains do share many characteristics with software companies, such as strong developer communities or common environments for deploying applications; however, the asset piece (i.e., cryptocurrency) is often ignored. The native currency to any blockchain serves as base money to incentivize a decentralized group of participants to behave in a coordinated fashion. As such, referencing blockchains as digital economies is more appropriate. Exhibit 3 highlights a few characteristics shared between countries and blockchains.”

“As presented in the introduction, it is more appropriate to compare decentralized blockchains to sovereign nations and their economies rather than web2 companies or products because of the embedded currency.”

HOLY SHIT

This goes back to one of my main points, which is that crypto as a sovereign financial system, is a key and perhaps THE key factor which makes the Network State and the sovereignty of venture capitalists possible and inevitable. This all goes back to sovereignty, incentives, design, infrastructure.

Base is a big step forward in the crypto agenda. Dismiss it at your peril. At no point has dismissing crypto as silly or juvenile done anything to move us towards ending this threat.

Have a fantastic day, share on socials, etc.